Guides

An Introduction to Staking

Discover everything you need to know about staking on Avail

Staking AVAIL Tokens

An Introduction

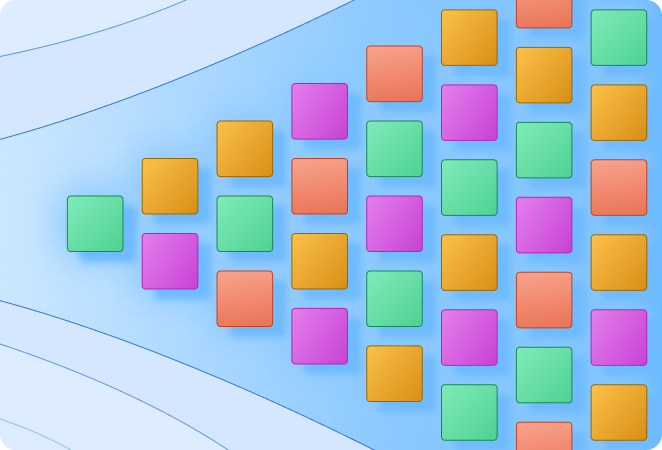

Nominated Proof of Stake (NPoS) Consensus Mechanism

Avail uses a Nominated Proof of Stake (NPoS) consensus mechanism. Let’s have a quick look at what that is.

Avail remains fully operational even under extreme circumstances and/or attacks as a combination of Blind Assignment for Blockchain Extension (“BABE“) and GHOST-based Recursive Ancestor Deriving Prefix Agreement (“GRANDPA“) is used as consensus mechanisms. While the BABE mechanism covers block production

BABE oversees block production, GRANDPA finalize blocks. In combination, both ensure the security of the chain and resolve forks.

Benefits for Token Stakers

Staking your AVAIL tokens to the network comes with different advantages. Let’s explore these in the following.

By staking AVAIL tokens in the network, stakers are lending their tokens to validators who then use these tokens to secure the network. As a reward for doing so, stakers receive a percentage of the validation rewards generated by validators. As such, staking rewards are designed as incentive for playing an active role in the security and governance of the Avail network.

Staking Options

When staking AVAIL tokens, users can choose between two options:

Comparison

Both options provide advantages for different user groups but also come with important considerations. The following comparison highlights the differences.

Nominating validators allows users to directly select the validator(s) of their choice by ranking and prioritizing them.

➕ This allows for a greater level of control over which validators are backed.

➖ On the other hand, this approach requires stakers to invest more time in selecting validators and monitoring their performance in the network.

➕ Users that are nominating validators themselves may generally see higher rewards than with using nomination pools.

Users prefering to play a less active role in the network can stake their tokens via nomination pools.

➖Pools may charge fees for handling the nomination process

➕ Lower entry barrier of 100 AVAIL (1,000 is needed for nominating a validator)

➖ Less control over which validators are being selected

Advantages of Nomination Pools

Nomination Pools come with important advantages for users seeking to take less responsibility than a staker who nominates validators. Nomination pools provide simplicity, a higher level of security, and are very convenient. However, this comes at the cost of having control over the selection of which validators to nominate and maximizing returns.

Minimum Stake / Minimum Bond

Validator Selection

When you are nominating validators, you can directly rank the validators of your choice or automatically select the best performing validators.

The following will show you what to consider when selecting validators.

- 1Validator Reputation: The ideal candidates have an excellent track record showcasing their reliability and they are also actively involved in the ecosystem

- 2Commission Rates: The higher the commission rate of a validator, the lower your return. Therefore, it’s very important to compare rates to find quality service for a fair fee

Validators charge a commission on the rewards they earn. Compare commission rates to find a balance between reasonable rates and quality service.

- 3Diversification: The best practice is to diversify by selecting multiple validators. This allows you to print your risk and to support the decentralization of the network.

Staking Rewards

Inflation is used to generate the staking rewards on the Avail network. As an incentive for providing data availability services and securing the network, the network rewards are distributed among validators within share these with their nominators based on the defined commission.

Distribution of staking rewards typically happens on an era basis (e.g., 1 era = 24 hours). At the end of each era, validators can claim their rewards.

Factors that influence staking rewards

Multiple different factors contribute to the amount of staking rewards that are generated. These include:

- 1Stake distribution: How staked AVAIL tokens are distributed

- 2Total network stake: The total amount of AVAIL tokens staked on the network

- 3Validator performance: Uptime and performance of the selected validators

- 4Validator commission: Commission percentage set by the nominated validators

- 5Network activity: Transaction fees generated